Step into the

Future of Lending

Future of Lending

Experience the power of an API-enriched &

AI-powered tech stack for new-gen lending!

2.5M

Users Onboarded

50+

Business Partners

₹5,000 Cr+

Gross Loan Value

₹2500 Cr+

Disbursal on Co-lending

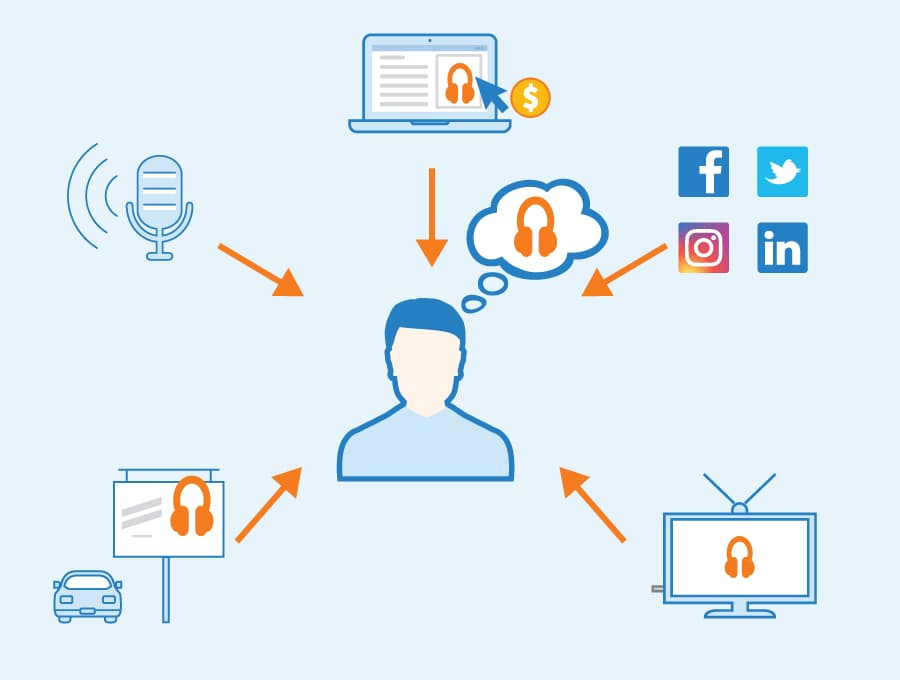

A Digital Lending Infrastructure that is SEAMLESS

We help Banks, NBFCs and E-commerce players streamline operations, reduce costs and address discrepancies in sourcing, credit decisioning.

Trusted by Leading Industry Players

Our Solutions

Meet Our Leader

As a LendTech solution provider, we bridge the gap between innovation and financial growth, empowering banks and NBFCs in India to embrace digital transformation seamlessly. Together, we drive inclusion, efficiency and a future-ready financial ecosystem.

- GAUTAM SINHA, CEO - LTFLOW

Case Studies

Client - Bank Of Maharashtra

Bank of Maharashtra wanted a co-lending platform to Co-lend and should support multiple lending partners in their backend.

Testimonials

Here's what our clients say

LT Insights